Cambodian Property Costs: A Complete Breakdown

We look at the full range of costs involved in owning, managing, buying and selling property in Cambodia. From transaction fees and annual taxes to rental obligations and exit costs, understanding these expenses helps ensure better financial planning and smoother real estate transactions.

With the evolving urban development surges and the demand for real estate growing in Cambodia, understanding costs and property taxation is essential for making savvy financial decisions.

Understanding current and future market trends helps investors forecast the best time to buy and sell their properties to maximise their returns.

Typical Property Purchase Prices

Property costs in Cambodia vary widely by city, type, and location. Boeung Keng Kang 1 is one of the most in-demand areas in the capital of Phnom Penh and the average price/sqm is US $2,000.

In terms of pricing in Phnom Penh, the average price per square meter in 2025 is US $1,800 gross, with Tonle Bassac demanding the highest prices of an average of US $2,500.

Transaction Costs & Taxes (Buying & Selling)

We provide a clear breakdown of the key taxes related to property ownership and transactions in Cambodia.

It should be noted that the implementation of the Capital Gains Tax has been postponed until the end of 2025, and there are also exemptions currently in place for certain cases under the Transfer Tax.

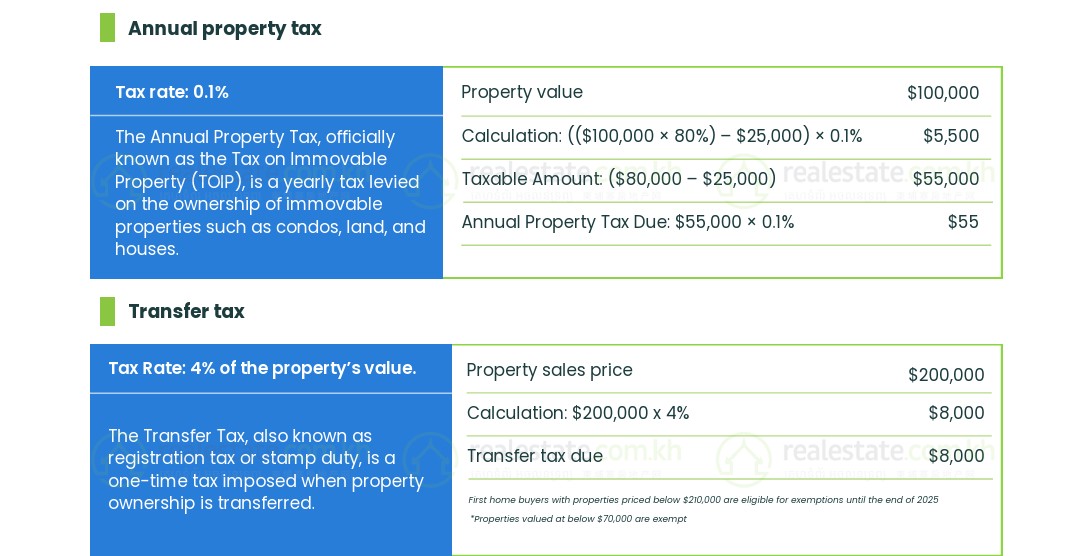

Stamp Duty/Transfer Tax

The Transfer Tax, also known as registration tax or stamp duty, is a one-time tax imposed when property ownership is transferred and is 4% of the government-assessed property value.

The Transfer Tax is levied to formalise the transfer of ownership and is paid during the property registration process.

Certain exemptions exist, such as for properties transferred between relatives or for government-conferred land rights.

- Rate: 4% of property value.

- Exemptions: First $70,000 is exempt. For first-time buyers purchasing from a developer, exemptions may cover up to $210,000 until the end of 2025.

- Who Pays: This tax is paid by the buyer, but negotiable.

Agent Commissions (Sale & Rental)

When you sell or rent your home through an agent in the Kingdom of Cambodia, you need to pay a commission fee for the agent's services.

The Ministry has taken direct measures to ensure that real estate operations run smoothly in the market and benefit both parties - agents and property owners. Usually, sellers pay the selling agent; buyers pay their own representative.

- Typical Commission Fee (Sales): 3–5% of the selling price (paid by seller or developer)

- Typical Commission Fee (Rentals): Typically 1 month’s rent for12-month contract (paid by landlord)

You can find out more about the Official Rates for Cambodia Agent Fees

Capital Gains Tax (*Delayed until at least the end of 2025)

Cambodia does not levy a capital gains tax on property currently, as the planned implementation has been delayed several times.

Once implemented, the Capital Gains Tax will be a tax applied to the profit earned from selling property. Taxpayers can choose between an 80% flat deduction method or deducting actual documented expenses to reduce their taxable gain.

Taxpayers will be able to choose between an 80% flat deduction without documentation or an actual expense deduction supported by evidence.

Legal Fees When Buying Property

Legal fees are typically 0.5%–1% of the property value (due diligence, SPA review, title transfer).

Cambodian Valuation Fees

Valuation fees are a professional estimate of a property's market value, used for sales, financing, or investment analysis.

Charged as a percentage of the property value:

- Below $100,000: 0.17% (min $170)

- $100,000–$1,000,000: 0.1% (min $900)

- $1M–$5M: 0.05% (min $2,000)

- $5M–$10M: 0.03% (min $1,500)

- Above $10M: 0.025%

- Example: For a $1.5M property, the total fee is about $1,320.

Due Diligence & Notary

Typically, these are included in legal and admin fees and are minor administrative costs depending on the property type/title.

Due diligence may add several hundred dollars if done by a separate firm.

Read More On Property Tax in Cambodia: What You Need To Know

Ongoing Property Ownership Costs

Property Tax (TOIP Tax)

The Annual Property Tax, officially known as the Tax on Immovable Property (TOIP), is a yearly tax levied on the ownership of immovable properties such as condos, land, and houses.

The value is assessed by the Immovable Property Assessment Committee. Key exemptions include properties valued at or below the threshold, agricultural land actively used for cultivation, properties owned by the government or diplomatic missions, and properties in Special Economic Zones serving agricultural, industrial, or service activities

- Annual Tax: 0.1% of property value over 100 million KHR (approx. $25,000).

Rental Income Tax

This is a tax on income earned from renting out property & rates vary for residents and non-residents.

There has not been great compliance in the past, but as Cambodia continues its push for tax reform and increased transparency, stricter enforcement could be introduced in the future.

This would make it crucial for property owners to stay informed and prepared for potential regulatory changes.

- Cambodian: 10% of gross rental income.

- Non-Cambodians: 14% of gross rental income.

Other Costs

- Property Insurance: (optional)

- Sinking Fund Contribution: One-time or annual contribution for long-term building repairs. This reserve pool of funds is collected from owners to cover the major long-term building repairs or capital improvements.

- Building Management Fees: Typically $1–$2 per sqm/month, covers security, cleaning, common area maintenance

- Unit Management Fees: Typically 5%–10% of monthly rental income; covers tenant handling, rent collection, and unit maintenance on behalf of the owner

- Utilities: Electricity, water, and depends on usage and provider (paid by tenants). The standard rate of utility is 0.25/kwh for electricity and 0.35/m3 for water.

VAT (If Rented Through a Company)

- 10% VAT is charged on rental income if held via a company.

Financing & Mortgage Costs

For Cambodian Citizens

Adjustments in pricing models are intended to appeal to a broader pool of buyers, domestically and overseas. The renewed focus is on making property ownership in Cambodia more accessible. Typically, some estimates might be:

- Down payment: 20%–30%

- Interest rates: 7%–10% annually

- Mortgage terms: Up to 20 years

For Foreigners Buying in Cambodia

Non-Cambodian citizens have limited access to traditional Cambodian bank mortgages unless purchasing via a local company. Foreign buyers should budget 6–8% of the property price for all open and hidden costs (stamp duty, agent, legal, admin, registration), not including financing or ongoing taxes.

Leading developers are offering smarter product offerings and more flexible payment plans. There might be developer financing options. These could include payment terms up to 50% of the payment due only at completion to ease buyer risk during the construction phase and help build confidence.

Tips When Looking For Condo Investment in Cambodia

Other Useful Terms To Know

- Instalment Payment - A staged payment model based on construction milestones or a fixed schedule, often used in off-plan purchases.

- Ownership Transfer - The legal registration of the unit under the buyer’s name, finalising ownership. Triggered after full payment and documentation.

- Payment Schedule - The timeline and structure of payments, often broken into booking, down payment, milestone payments, and final balance.

- Rental Returns or Yield - The annual rental income expressed as a percentage of the unit's purchase price. E.g., $12,000 income on a $150,000 unit = 8% yield.

- Sales & Purchase Agreement (SPA) - The legal contract between buyer and developer that outlines payment, handover, and ownership terms.

Cambodia’s property costs are lower than many regional markets, and the main expenses are the purchase price, stamp duty, commissions, legal fees, and an annual property tax that is generally minimal.

Foreign buyers should factor in slightly higher total upfront costs for due diligence and potential financing arrangements, but the yields and entry costs are extremely competitive, and the market is attracting a wider range of foreign buyers as well as growth from the domestic market.

Comments