Last week, we looked at the latest Cambodia Real Estate Highlights H1 2025 report and data from Knight Frank Cambodia with a focus on Phnom Penh. This time, we review the trends and statistics for Sihanoukville and Siem Reap.

Knight Frank singled out the coastal city of Sihanoukville as one to watch as it continues to rise as a future gateway city, driven by infrastructure and port development.

Siem Reap Tourism

Knight Frank said in their report that Siem Reap’s tourism recovery in 2024 continued into the first half of 2025 to start with, but unsurprisingly, by Q2 2025, the numbers were being impacted by the closure of the Cambodia-Thailand land border and ongoing tensions.

Almost half of all international arrivals (which really means regional) arrived in Cambodia by land and sea borders, so the closure of the border will continue to have an adverse impact, as most visitors travelled overland from Thailand.

In the long term, a lot of hope and optimism is being placed on the success of the new Techo International Airport in the capital, which launches in September 2025, as well as the existing Siem Reap-Angkor International Airport. The report suggests this needs to be reinforced by efforts from various sectors and the Cambodian government to promote Siem Reap and arrange meaningful events to attract visitors.

Initiatives such as the Angkor Sankranta 2025, the Green Season Campaign and Cambodia-China Tourism Year 2025 are all underway but “the development of more tourist attractions to encourage tourists to visit Cambodia, whilst increasing the average length of stay” is needed.

Ticket sales and visitors to the Angkor Archaeological Park have been showing improvements year-on-year since the pandemic, and visitors primarily came from China, the United States, the United Kingdom, Australia, France and Japan, but the numbers for the second half of 2025 should again show the impacts of the Thailand situation.

Read More - What’s New for Travellers in Cambodia 2025: Essential Updates

Siem Reap Residential Sector H1 2025

The area showcased landed housing developments and modern borey developments, but the “market faced slow absorption rates for units further from the city centre”.

Condominiums outperformed landed housing sales in Siem Reap, and the residential rental market experienced a moderate recovery, too. The sales performance of landed housing developments located more than 10 km from the Siem Reap city centre was minimal.

The smaller population of 250,000 indicated minimal demand from the Cambodian residents for residential property, and “many opted to buy land and build their own accommodation”, said the report.

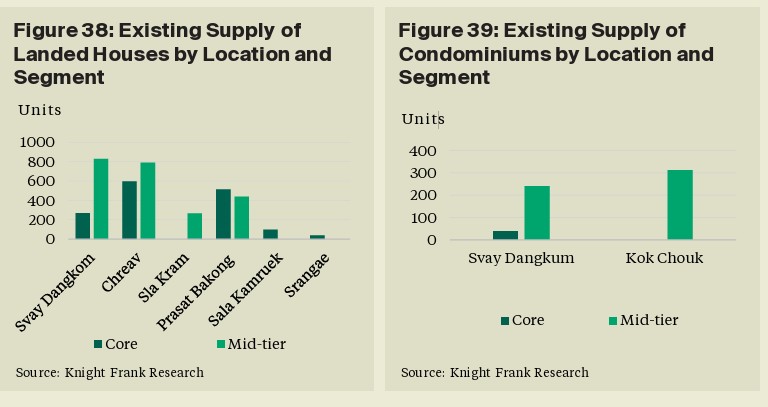

- There were a total of 3,849 landed housing units across 27 projects, priced from US$430 to US$1,700 per sqm of gross floor area.

- An additional 1,709 units are expected to enter the market from 2025-2028.

- Condominiums were priced between US$1,100-2,700 per sqm.

- Gross rental yields were 6-7 per cent

Siem Reap Hotel Sector H1 2025

There were signs of recovery, but the sector will show a downward trend in the second half of the year due to the aforementioned issues.

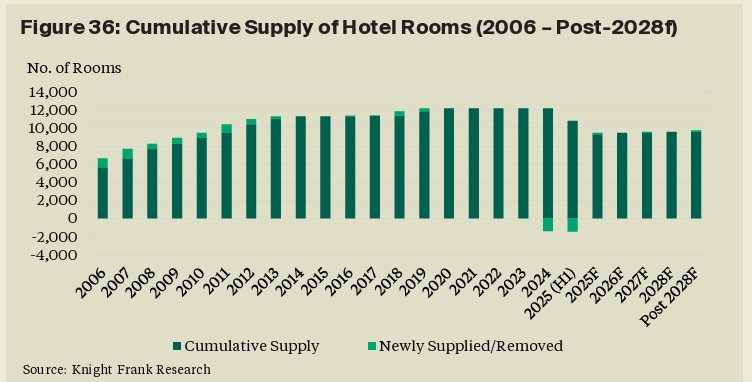

The report states that there are limited hotels in the development pipeline, and the projects underway are: Angsana Siem Reap (due H2 2025), PARKROYAL (2027) and Rosewood Siem Reap is also anticipated “but remains unconfirmed”.

- Siem Reap’s hotel supply was 9,584 rooms.

- Most of this supply is in Svay Dangkum (51%) and Sla Kram (29%)

Siem Reap Retail Sector H1 2025

The Siem Reap retail sector continued to face challenges, and one of the reasons was that a majority of tourist arrivals were budget travellers.

- The retail supply has been reduced by 20,920 square meters in the past couple of years due to ‘underperformance in some retail malls and a growing interest in opening locations along main roads in traditional shophouses’.

- Malls such as Angkor Fashion Plaza, Thai Huot Supermarket, and Angkor Trade Center have ceased operations.

- Angkor Market has expanded, while The Heritage Walk, CDF Angkor Duty Free, Asia Plaza and Makro Siem Reap are “in operation with a healthy performance.”

- The Pizza Company, Swensen’s, Dairy Queen, Domino’s Pizza, Tummour, KFC, Burger King, Brown Coffee and Temple Coffee & Bakery have established outlets

The report adds that there could be growth “in targeted local expansions and new businesses that focus on providing intimate customer experiences”.

Sihanoukville H1 2025

The city has shown signs of a recovery, but the outlook remains mixed for Sihanoukville even though the area serves as the centre for trade and logistics and is a hub for manufacturing and industrial sectors, as well as tourism.

In addition to the ongoing infrastructure projects, other industrial projects were approved in Preah Sihanouk Province, as well as more special economic zones (SEZs).

- Up to May 2025, 297 projects worth $7.03 billion will receive in principle approvals and tax incentives as part of a beautification initiative for Sihanoukville.

- The land market has been slow, and there remains uncertainty about long-term recovery.

Sihanoukville Residential Sector H1 2025

The residential sector was subdued due to limited new demand and because of the smaller population in the region. The residential market is not yet seeing an uptick in activity.

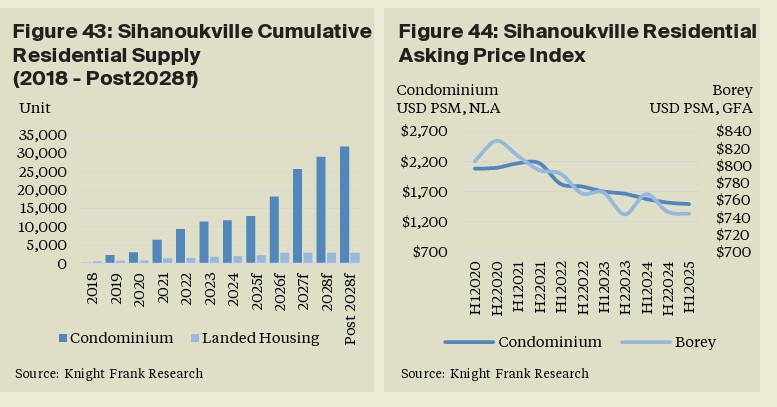

- 11,742 units across 21 projects were recorded in the existing supply

- Some beachfront developments have attracted buyers

- If all current projects resume over the next five years, the condominium numbers could reach 31,824 units by 2029

- Only one condominium project was launched in Sihanoukville in H1 2025 - Time Square 10 Ocean View

- There is a total of 1,757 landed housing units in Sihanoukville's existing stock

Moving forward, there remain headwinds and developers “will focus on finishing or repurposing existing projects instead of starting new ones,” explained the report. It also said that developers should prioritise affordable housing targeted at local Cambodians.

Read More - DoubleDragon's Hotel101 Enters the Cambodia Market with Developments in Phnom Penh and Sihanoukville

Sihanoukville Hotel Sector H1 2025

Sihanoukville is undergoing a transformation in the hotel sector due to the entry of international brands with increased room capacity.

- The existing supply of hotel rooms was recorded at 12,243 keys.

- Approximately 10,084 new hotel rooms are expected to be added to the market over the coming years.

- Two international hotel brands entered the market in H1 2025

- Hotel room distribution is concentrated in Sangkat Boun (47%) and Sangkat Bei (44%) of the total capacity.

The long-term outlook is “cautiously optimistic” as the Royal Government of Cambodia tries to address challenges and develop infrastructure to improve connectivity to Sihanoukville.

Industrial & Commercial Sectors - Sihanoukville

Real estate and gaming account for less than 20% of total FDI inflow in Sihanoukville, which is markedly lower than 60% in 2019.

Sihanoukville is focused on its industrial activity in SEZs and the deep-sea port. Overall, there is a “shift from a short-term speculation destination to a key hub for industrial logistics, advanced manufacturing, and sustainable tourism.”

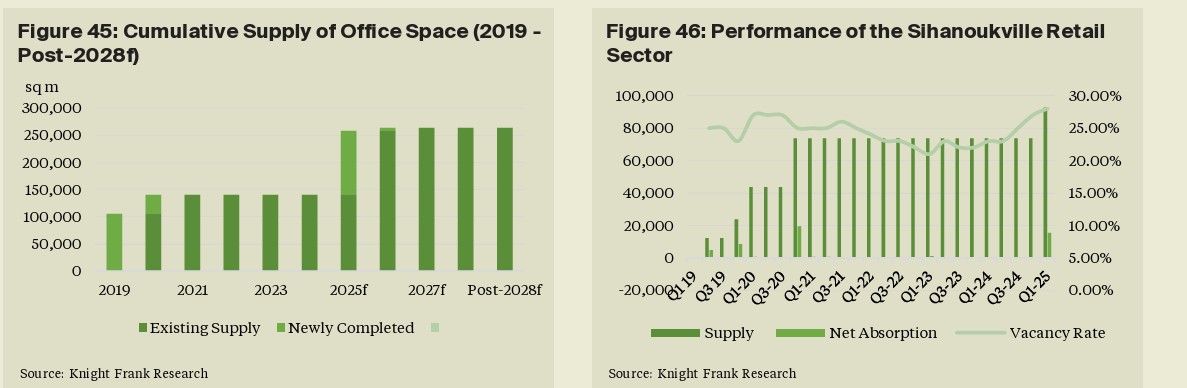

The commercial landscape showed an increase in activity, and the office and retail sectors saw “significant developments” with the office sector seeing record new completions during H1 2025.

- The existing supply of office space totalled approximately 192,390 sqm of net leasable area (NLA) - reflecting a consistent trend of growth.

- There is an additional 71,309 sqm of office NLA recorded in the development pipeline.

- Retail space supply was recorded at 92,718 sqm of NLA.

- The retail supply is expected to increase by 62,933 sqm over the coming years.

The same challenges exist in terms of geopolitical tension, but the infrastructure projects could mitigate some risks, as the province is positioned to be a logistics hub, which should increase demand for both office and retail space.

Comments